Having your sums insured correct is one of the most contentious areas of insurance.So often we see people suffer a major incident only to find they do not have sufficient cover to rebuild or replace all of their goods.

Recently a family with three children, five people overall, had the trauma of a bushfire and the loss of their home compounded by having only $35,000 in contents cover. This was not enough to even replace their clothing.

A terrible emotional toll can be minimised financially by ensuring your sums insured are correct. In this section of the blog we tell you how to get them right.

Building

There are a number of ways in which you can estimate the cost to rebuild your home and we take you through various options that will ensure you get the figures right.

Builder or Quantity Surveyor

The most accurate way to calculate the cost to rebuild would be to get an actual quote from a builder. You would need to contact a builder who has knowledge of local regulations and standards and ask him to provide a formal quotation.

There is a lot of work involved in quoting to build a house and the builder may want to charge for his time.

A quantity surveyor estimates the cost of construction and many offer the service to calculate your sum insured. They will charge for this service but once completed you will have a formal report that includes the cost to rebuild including any difficulties, Council fees and other items.

Online calculators

There are websites that will do the job for you and we felt one of the best to be via the Insurance Council of Australia website. It transfers you to the Cordell Sum Sure site. To operate the calculator you have to have some basic knowledge of your house but it is easy to operate and seems reasonably accurate.

You do have to put your name and email address into their system to get the calculations and there is a lengthy disclaimer. They email you a report that you can send to your insurer or broker.

Do your own estimate

Unless you work in the building industry and have a good working knowledge of building costs then we suggest you opt for one of the other systems.But should you feel confident in being able to work out the figures yourself below is a list of things that you need to include.

The house

Garage and carport

Pergolas and decks

Garden sheds

Retaining walls

Paved areas including terraces

Granny flat, sleepout or other separate building.

Heating and cooling

Solar systems

Swimming pools and spas

Driveways

Garden edging

Fencing

Built in awnings and shade structures

These are just a few of the items you should include in your calculations of the sum insured.

Also, remember that some policies require you to have demolition, professional fees (surveyors, engineers etc) and other things in your sum insured. You will need to read through the PDS to determine if this is the case for you. For example, some Elders and QBE policies are like this.

Contents

To calculate an accurate sum insured is more difficult and time consuming but again there are various ways in which you can do this or get help.

Manually

This link will send you to a standard form you can use to list all of your contents on a room by rooms basis. Remember to include things in drawers, cupboards and on shelves and be thorough to ensure all items are included.

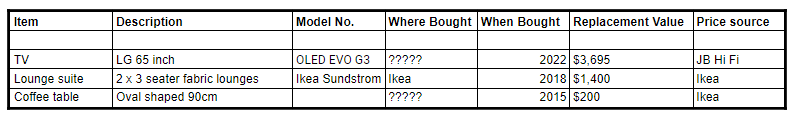

A typical example for a family room is as follows.

Once you have included all of the items you own, the difficult part starts. You have to now price each of the items on a new basis. That is the retail price you pay at a local or online shop. Even the old table you inherited should be priced on a new for old basis. Try and find the price to buy a similar table online, include GST and remember to include delivery.

Once all rooms have been completed, add up the totals and this becomes your sum insured. I think you will be surprised at how high it is.

Note that your carpet and window treatments are contents.

Online calculator

If the above seems like a lot of work (and it is) you may want to look at getting an estimate from an online contents calculator. Be careful though as the calculators are based on the limited knowledge obtainable for your address that may not be 100% accurate.

Again the contents calculator in the Insurance Council of Australia website seems reasonably good and takes you to suminsured.com.au. The calculator arrives at a sum insured and is editable should you feel it is not very accurate.

We urge caution with this system as it seems to be based on averages for the amount of people living at the property. If you hold expensive or unusual contents, this system would not include the extra expense of replacing these items.

Some policies have limits on the amount you can claim.

Most policies limit the amount you can claim on certain individual contents. This means that should your $25,000 ring be stolen then the amount you can claim will be limited to say $5,000. All policies are different and we advise you to read through and understand what the limits are in the policy you bought.

Typical examples of things that have limits are as follows.

Tools of trade – perhaps you should be thinking about portable tools of trade cover

Office equipment used for a business – you should have business cover

Frozen food and medications

Jewellery and watches

Hand knotted rugs or carpet such as Persian rugs

Memorabilia

Collections such as coin collections, book collections.

Paintings

Works of art including sculptures,ornaments etc

Antiques

Cash

Contents that are outside your house, for example an outdoor dining setting or barbeque

Should you have some of the above items and the cost to replace them (new for old remember) is more than the limit, don’t worry you can always phone or email your insurer and get extra cover for these individual items. They will charge you extra for them but you will be covered for the full cost of replacement. They should also send you an updated policy schedule that lists the extra cover you have taken out, check to ensure it is right.

Some things are not covered.

Most insurers attempt to capture all items that you own that cannot be separately insured but limit or exclude items that can be insured elsewhere. The below is a list of items that are often excluded, again all polices are different and you should read the PDS or phone the insurance company to clarify if this affects you.

Caravans and their contents

Electrical items not able to be used, old TV for example

Uncut gems

Unregistered firearms

Motor vehicles including their accessories

Motor bikes

Trailers

Pets or animals

Plants

Samples, stock or things used as part of your business.

Bank cards, phone cards, tickets, vouchers etc

Finally, we cannot stress enough the importance of getting your sums insured correct. Not doing so is akin to insuring some of your home or its contents yourself. You would not dream of taking out a policy on only the kitchen and living area but excluding the bedrooms and bathrooms but that is really what you are doing by understating your sums insured.

The cost of a policy with $800,000 cover is not much more than one for $600,000 so we urge you to take the time, be thorough, get the advice you need and don’t guess.